Uncategorized

Research on household appliances industry-2022-06-01

1) Grasp the main line of steady growth and adapt to the layout on the left

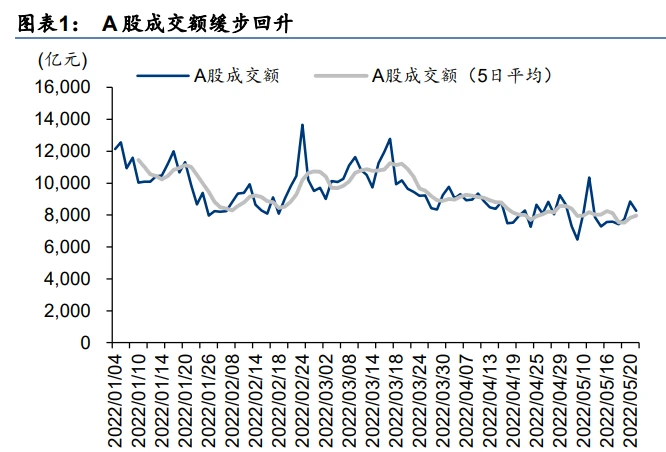

Since 4q21, the volatility of a shares has increased, and the earnings uncertainty in 1q22 has been disturbed continuously, and the deleveraging trend in the market is obvious. However, we believe that, on the one hand, the steady growth support policy continues to appear, which is conducive to attracting off-site funds to converge on the floor again. From the transaction volume of a shares, it can be seen that the transaction volume gradually rebounded after the bottom of 5/9. On the other hand, the risk appetite on the floor also gradually increased. The balance of the two financials hit the bottom of 4/29. The main contradiction in the market has changed from the total amount to the structure. Steady growth is the clearest main line, In the future, there may continue to be favorable supporting policies, and the allocation of funds is expected to raise the valuation center of the undervalued household appliances sector.

Although the stock capital is still switching between the old boom sector and the stable growth sector repeatedly, we believe that the prosperity recovery in 3q22 “stable growth” related fields is expected to be stronger, and the on-site liquidity is expected to focus on the advantageous fields with policy preference, among which the household appliance sector is expected to benefit from stable growth + epidemic recovery.

The central government has repeatedly mentioned boosting consumption, and proposed to reduce the purchase tax of some passenger cars by 60billion yuan at the May 23 meeting. At the same time, through financial subsidies and profit transfer by enterprises or platforms, local governments introduced consumption promotion measures in at least 16 provinces and 27 relevant regions from early April to late May, and invested about 5.34 billion in consumption vouchers, shopping subsidies, etc. Among them, the subsidy category of household appliances is mainly concentrated in large household appliances that meet the new energy efficiency standards, which is more conducive to the popularization and promotion of green and energy-saving products.

2) See more about segmenting boom sectors and pay attention to defense value

The safety margin value of household appliances is prominent. Household appliance stocks have the characteristics of bottom position and defensive. From a long-term perspective, the growth contributed by the performance drivers of household appliances and other consumer sectors is stronger than that driven by valuation in most periods of time. At present, the value of undervalued value and high safety margin at the time point is more prominent. The valuation repair brought about by capital allocation is also expected, which has the characteristics of left layout. At the same time, the areas with high mesoscopic bearing in the subdivision plate have more offensive characteristics.

White electricity: the most mandatory attribute, and the pattern advantage brings the anti inflation cycle ability

On the whole, the valuation of the sector is not high, and white electricity has a strong mandatory attribute, making it easier to benefit from inflation. The differentiation of white power’s business situation is obvious, which drives the change of capital preference. Haier is relatively outstanding in various segments, and is expected to achieve excess returns.

Chef’s electricity: the integrated kitchen view has been improving for a long time, and the traditional smoke kitchen has benefited from the policy of stabilizing real estate

Although the short-term demand is affected by repeated domestic epidemics, the logic of increasing the penetration rate of integrated stoves is still tenable. We continue to be optimistic about the medium – and long-term growth attributes of integrated stoves. While the traditional smoke stoves are dragged down by the weak sales data of new houses in the upstream, and the year to date valuation has been continuously adjusted. At present, the valuation of relevant stocks is at the historical bottom, with a margin of safety.

Clean small electricity: it is still a prosperous track, continuing structural growth

In 2022, the clean electrical appliance industry will continue the market style of structural growth, and the self-cleaning floor sweeping robots and floor washers will benefit first. In the short term, by virtue of the new product effect, the share of leading brands has been continuously increased and the brand pattern has been optimized; In the medium and long term, innovation drives development. At present, the penetration rate of domestic clean electrical appliances is low. With the investment of R & D resources, we are optimistic about its long-term development space.

Small kitchen appliances: profit elasticity is expected to drive valuation differentiation

The competitive pressure on the revenue side has been strengthened, and the cost of online traffic has also increased. However, we are optimistic that the cost pressure on 3q22 will be relieved. ODM export-oriented enterprises benefit from the depreciation of the RMB exchange rate. Driven by the recovery of costs and profits, small kitchen appliance enterprises have a high probability of recovering profits. At the same time, small kitchen appliance enterprises exporting to the United States benefit from tariff relief.

3) Stock bond yield: the fluctuation of bond bond yield difference indicates the stage opportunity, and it is optimistic about the subsequent relative return

The fluctuation of debt stock return difference indicates that there is a certain low-level opportunity in the household appliance sector, which is in line with the configuration and repair logic after the bad situation is exhausted. Since the end of April 2022, the price performance of the home appliance (Shenwan) index has been outstanding. The yield difference between the 10-year Treasury bond yield minus the dividend yield of home appliances has been lower than twice the standard deviation of the past average. The high-quality household appliance enterprises have controllable operational risks and stronger cost transfer ability. The competitive environment is conducive to the concentration of market share of leading enterprises. We expect that under the condition that the expected rate of return of the whole market is declining, the leading assets of household appliances with more moderate types are expected to achieve excess returns in the third quarter.

Looking back at the performance of the home appliance (Shenwan) index in the past 10 years and the performance of the 10-year Treasury bond yield – the dividend yield of the home appliance sector, when the yield difference of the Treasury bond minus the dividend yield fluctuates to -2 times the standard deviation (the core is the 10-year Treasury bond yield – the 1-year rolling average of the dividend yield of the home appliance sector, and the corresponding standard deviation is calculated), the cost performance of the home appliance index has improved significantly, and the opportunities for the sector are highlighted, In the past 10 years, the home appliance (Shenwan) index has had 8 similar opportunities. Since the end of April 2022, the yield difference between the national debt and the dividend yield of household appliances has fluctuated again to -2 times the standard deviation. We believe that the cost performance of leading household appliance enterprises is more prominent, and the price factor of raw materials has been fully reflected in the recent performance of the sector. Under the condition that household appliances have long-term growth space, the average price has generally increased due to the increase of the superimposed cost of renewal demand, and the industry competition pattern is better Enterprises with stronger brand influence may perform better than the industry when the average price increases and the consumer preference increases.

1h2022 review: the prosperity continues to be low and the epidemic recovery is expected

In the first half of the year, the impact of external factors was negative, and the share price of household appliances fell by 18.7%

Since 2022, the share price of the home appliance sector (Shenwan) has continued to be weak after a short-term recovery. As of May 20, 2022, the home appliance sector has fallen by 18.70% in 2022, ranking 20th among the 30 Shenwan sub industries. At the beginning of 2022, the market expected to restore the profitability of the home appliance sector, but it was constantly disrupted by changes in the external environment. The continuous rise in raw material prices hit the net profit performance hard. In addition, the export marginal pull force was expected to weaken. In March, the epidemic rose again, and the overall stock price fell significantly. However, driven by the main line of steady growth, the sector stabilized in April, but the valuation of the sector has dropped to a lower level, The valuation of the emerging growth track has also been adjusted to a relatively reasonable level. We believe that we should pay more attention to the quality of operation, so as to stabilize the dividend and anchor the defense value. The leader and the leader of the segment track may be in the middle and long-term configuration window.

Since the last trading day in April, the household appliance sector has recovered, and the valuations of various leading enterprises have recovered. Although the epidemic rose again in March, the year-on-year growth rate of 1q22 revenue in the household appliance sector is not pessimistic, and the profit performance is better than the revenue. On the one hand, the market expects consumer demand or centralized release during 618. On the other hand, under the support of the steady growth policy, 2q22 revenue may not be pessimistic, In addition, the correction of the valuation of the sector and the performance of the share price have reflected the expectation of pressure on the net profit.

Demand has not recovered yet, and the prosperity is low

The prices of consumer goods and raw materials are rising, and the terminal demand is still unstable. Under the stagflation environment, the price rise of upstream raw materials is strongly constrained by the supply side. The price of consumer goods rises with the cost, and begins to restrain consumption. Recently, the year-on-year growth rate of domestic retail sales and export sales in the household appliance industry is weak, and the decline can be reversed in the short term through the promotion of e-commerce Festival. However, the medium and long-term prosperity still relies on macroeconomic changes and the cyclical pull of real estate. At present, there is no trend opportunity.

On the export side, the overseas demand has weakened. We believe that the consumption in the European and American markets represented by the United States may remain resilient in 2q22-3q22. In April 2022, the number of new housing starts in the United States decreased by 0.2% to 1.72 million units a year. After the overseas epidemic eased, social activities increased and service related retail performance was better. At the same time, the U.S. retail sales (excluding cars) in April were +0.9% month on month, The consumption of household durable goods maintained a similar growth rate, with electronics and appliances (mom +1.0%) and furniture (mom +0.7%), but the export base of household appliances is high or facing the pressure of slowdown.

White power: the prosperity of domestic and foreign sales is weakening, and Haier has a strong performance

The long-term logic of the traditional category of air and ice washing is clear, and the short-term prosperity is still weak. In the long run, there is still room for the improvement of air conditioners’ ownership (CAGR of internal and external sales in 2011-2021 were +3.4% and +3.4% respectively). There is more room for growth in domestic sales and exports, while ice washing products are mainly updated. In the past few years, washing machines have benefited from the upgrading of roller products, and their domestic sales performance is better than refrigerators (CAGR of internal sales of ice washing in 2011-2021 were -3.2% and +2.0% respectively), but there is relatively little room for growth in domestic sales, The advantages of the ice washing export industrial chain have been continuously strengthened (the CAGR of the ice washing export sales from 2011 to 2021 were +8.6% and +4.5% respectively), but the catalytic factors of the epidemic are weakening. We also pay attention to the outstanding performance of clothes dryers in emerging categories (reflecting the new demand brought about by technological iteration and lifestyle change). Meanwhile, the growth of refrigerators highly related to the food storage demand of the epidemic is leading and the 2q epidemic has promoted the catalytic growth. The excellent performance of the market segment reflects that solid demand is the driving force for the growth of household appliance sales.

In the domestic market, both air and ice washing are weakened, and Haier performs prominently

The retail demand for air conditioners is weak, but Haier’s share has increased and its performance has taken the lead. In 2022, the online retail sales of w1-w20 (1.1-5.15) air conditioners will be yoy-11.6%. 2q weakened significantly. In 2022, the online retail sales of w13-w20 (3.28-5.15) air conditioners were yoy-24.1%.

The demand for refrigerators has weakened slightly, and the demand is still strong, but it has continued to grow at a high base. In 2022, the online retail sales of w1-w20 (1.1-5.15) refrigerators will be yoy-1.7%. In 2022, the online retail sales of w13-w20 (3.28-5.15) refrigerators will be yoy-2.5%.

In the export market, there is insufficient action in terms of volume, and the price performance of air conditioners and washing machines is relatively good

Overseas consumption of durable goods has also weakened. After the epidemic eased, the consumption structure has been adjusted, shifting from household durable consumer goods to service-oriented consumption. In April 2022, the export volume of household appliances was 311.65 million units, a year-on-year -4% (cumulative year-on-year -6.8% from January to April), and the export amount was RMB 50billion, a year-on-year -7% (cumulative year-on-year -7.2% from January to April). According to the data of the General Administration of customs, in April 2022, the export volume of air conditioners was 5.74 million units, Year on year -13% (cumulative year-on-year -5% from January to April), the export volume of air conditioners is still weak, but the average price continues to rise. The average export price of air conditioners is 1083.2 yuan, a year-on-year +14% (cumulative year-on-year +10% from January to April). Driven by the increase in average price, the export amount of air conditioners in April 2022 is 6.218 billion yuan, a year-on-year -1% (cumulative year-on-year +5% from January to April).

According to the data of the General Administration of customs, in April 2022, the export volume of refrigerators was 5.71 million units, a year-on-year -11% (cumulative year-on-year -10.3% from January to April), and the average export price of refrigerators was 850.17 yuan, a year-on-year -2% (cumulative year-on-year +2% from January to April). The export scale of refrigerators was still at a high level, but under the influence of the base, the same rate of growth of export volume fell, and the average price also fell significantly. Affected by this, the export value of refrigerators in April 2022 was 4.85, Yoy -13% (cumulative YoY -9% from January to April).

In April, 2022, the export volume of washing machines was 1.42 million, a year-on-year -28% (cumulative year-on-year -19.4% from January to April). The average export price of washing machines was 924.79 yuan, a year-on-year +9% (cumulative year-on-year +8% from January to April). The export volume of washing machines was similar to that of refrigerators, but the average price was better than that of refrigerators. Affected by this, in April, 2022, the export value of washing machines was 1.313 billion yuan, a year-on-year -22% (cumulative year-on-year -4%.

Hi, this is a comment.

To get started with moderating, editing, and deleting comments, please visit the Comments screen in the dashboard.

Commenter avatars come from Gravatar.